Survey of macroeconomic forecasts - November 2009

Macroeconomic forecasts' survey

The last, 28th Colloquium took place in November 2009. Results of the survey are based on forecasts of 15 domestic institutions (Cyrrus, CNB, ČSOB, Generali, Chamber of Economy, Komercni banka, Liberal Institute, MoF, Ministry of Industry and Trade, Ministry of Labour and Social Afffairs, Patria, Raiffeisen, Union of the Czech and Moravian Production Cooperatives, UniCredit, Wood & Company). To make the survey more representative, forecasts of 3 international institutions were added (European Commission, IMF, OECD).

The aim was to assess key tendencies within the horizon of years 2009 through 2012 where years 2011 and 2012 were regarded as indicative outlook. The key indicators and comparison with October MoF forecast are summed up in Tables 1 and 2.

In general it can be summed up that MoF forecasts keep to the average of other institutions' forecasts but are slightly more pessimistic, not allowing for such a fast recovery of the economy.

| 2009 | 2010 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| min. | consensus | max. | MoF CR | min. | consensus | max. | MoF CR | ||

| Gross domestic product | increase in %, const.pr. | –5,3 | –4,4 | –4,0 | –5,0 | 0,0 | 1,1 | 2,3 | 0,3 |

| Consumption of households | increase in %, const.pr. | 0,4 | 1,0 | 1,6 | 0,7 | –1,5 | –0,1 | 2,0 | –1,3 |

| Consumption of government | increase in %, const.pr. | 1,0 | 2,3 | 4,3 | 2,0 | –2,2 | 0,3 | 4,5 | –1,0 |

| Fixed capital formation | increase in %, const.pr. | –14,0 | –7,7 | –5,5 | –7,8 | –3,9 | –1,0 | 2,0 | –3,9 |

| Inflation rate | per cent | 0,3 | 1,0 | 1,5 | 0,9 | 1,1 | 1,5 | 2,0 | 1,4 |

| GDP deflator | increase in %, const.pr. | 1,3 | 2,9 | 4,2 | 2,7 | 0,2 | 1,3 | 2,8 | 0,2 |

| Employment | increase in per cent | –2,5 | –1,8 | –1,3 | –1,3 | –2,7 | –1,2 | 1,5 | –1,9 |

| Unemployment rate | average in per cent | 6,5 | 7,1 | 8,3 | 6,5 | 7,5 | 8,4 | 9,8 | 8,4 |

| Wage Bill (domestic concept) | increase in %, curr.pr. | -0,3 | 0,5 | 2,5 | –0,3 | -1,1 | 0,6 | 3,0 | –1,1 |

| Current account / GDP | per cent | –3,0 | –1,8 | –1,0 | –1,4 | –3,0 | –1,3 | 0,4 | 0,4 |

| Crude oil Brent | USD / barrel | 60 | 67 | 77 | 61 | 75 | 79 | 85 | 79 |

| 2011 | 2012 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| min. | consensus | max. | MoF CR | min. | consensus | max. | MoF CR | ||

| Gross domestic product | increase in %, const.pr. | 1,0 | 2,4 | 3,5 | 2,8 | 2,0 | 3,2 | 4,8 | 3,3 |

| Consumption of households | increase in %, const.pr. | 0,2 | 1,5 | 3,0 | 2,3 | 1,5 | 2,6 | 4,0 | 2,5 |

| Consumption of government | increase in %, const.pr. | –1,0 | 1,0 | 4,5 | –0,6 | –0,2 | 1,5 | 4,5 | –0,2 |

| Fixed capital formation | increase in %, const.pr. | –1,0 | 2,3 | 4,5 | 2,5 | 1,0 | 3,9 | 7,0 | 3,6 |

| Inflation rate | per cent | 1,4 | 2,2 | 3,0 | 1,8 | 1,8 | 2,4 | 3,0 | 2,0 |

| GDP deflator | increase in %, const.pr. | 1,3 | 1,9 | 2,3 | 2,3 | 1,5 | 1,8 | 2,3 | 2,0 |

| Employment | increase in per cent | –0,5 | 0,5 | 1,5 | 0,0 | 0,4 | 1,2 | 2,0 | 0,9 |

| Unemployment rate | average in per cent | 7,0 | 8,0 | 9,0 | 8,2 | 5,0 | 6,9 | 7,8 | 7,4 |

| Wage Bill (domestic concept) | increase in %, curr.pr. | 1,1 | 3,5 | 5,7 | 4,5 | 2,5 | 4,3 | 7,5 | 5,3 |

| Current account / GDP | per cent | –2,7 | –0,7 | 1,0 | 0,6 | –2,7 | –1,1 | 0,5 | 0,8 |

| Crude oil Brent | USD / barrel | 75 | 85 | 95 | 93 | 80 | 97 | 110 | 93 |

Main expected tendencies of macroeconomic developments can be summed up as follows:

-

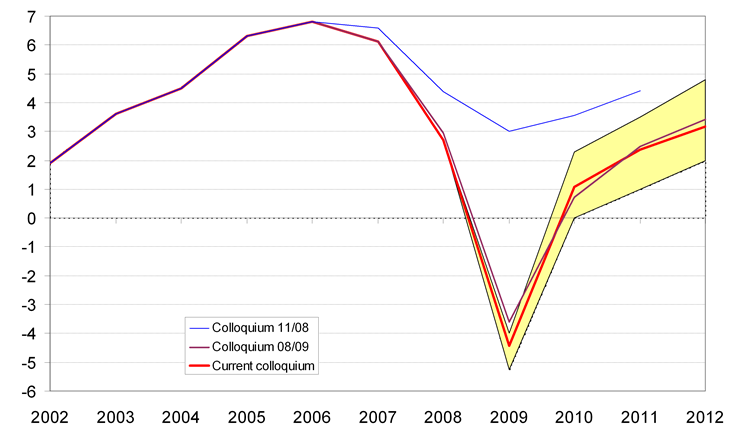

For 2009 institutions expect GDP to shrink by 4.0-5.3 %. MoF estimate of the economy's decline by some 5 % ranks the ministry among the more conservative institutions. The same applies to 2010 when stagnation or recovery of the Czech economy is expected; in comparison with average of forecasts, the MoF expects a slighter recovery. Outlook for 2011 and 2012 puts the October MoF forecast close to median values of the entire survey (deviation by 0.4 p.p. in 2011 and 0.1 p.p. in 2012).

-

Average rate of inflation should stick to low levels. After this year's marked disinflation, average rate of inflation should shift close to new 2 % inflation target of the CNB in the following years. The MoF forecast is in accordance with forecasts' average.

-

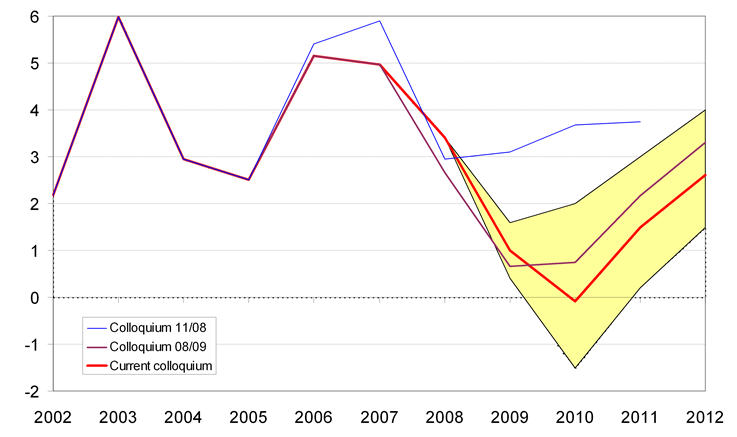

According to consensus forecast, decline in employment and rise in rate of unemployment should be seen in this and next year. As regards outlook for 2011 and 2012, institutions allow for reverse tendencies i.e. for growth of employment and lowering of rate of unemployment. The MoF forecast for 2010-2012 is in full accordance with the consensus.

-

Current forecasts allow for steep slowdown in growth of wage bill (in current prices) from 8.7 % in 2008 to some 0.5 % in this and next year, while even a decline cannot be excluded. Growth dynamics should gradually recover in the following years. MoF forecast for this and next year is conservative in comparison with average forecast.

List of indicators:

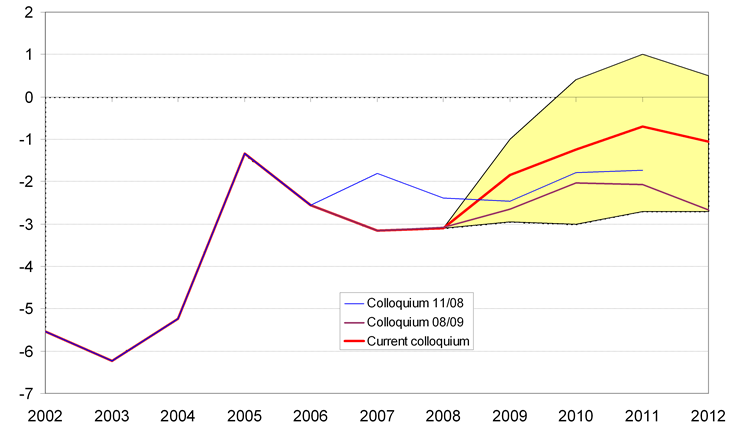

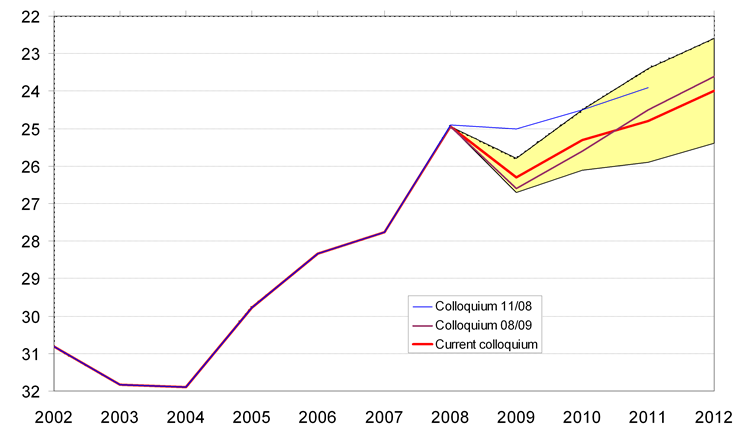

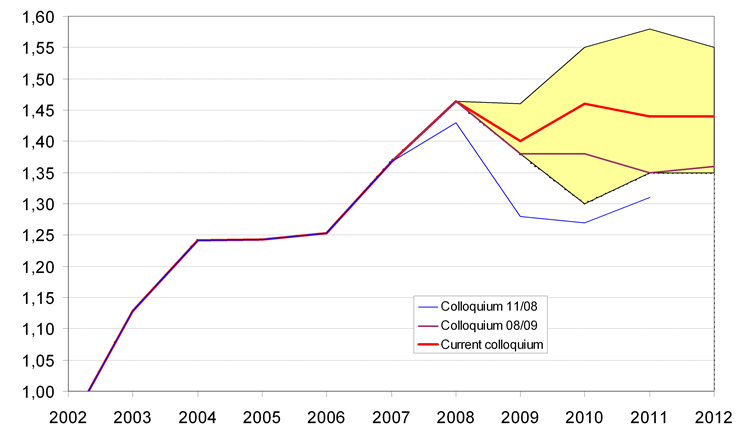

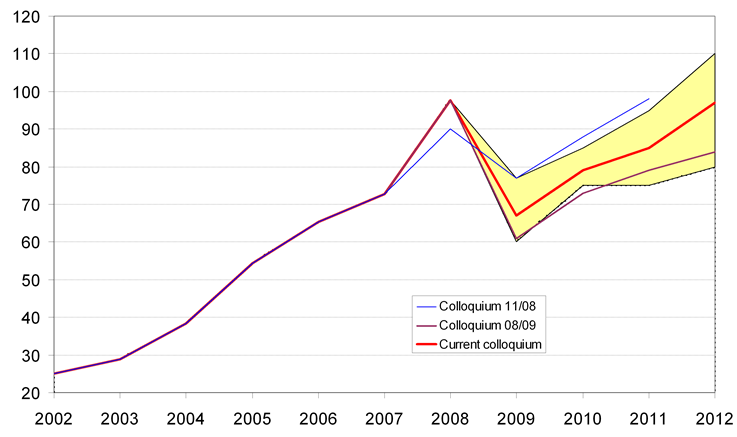

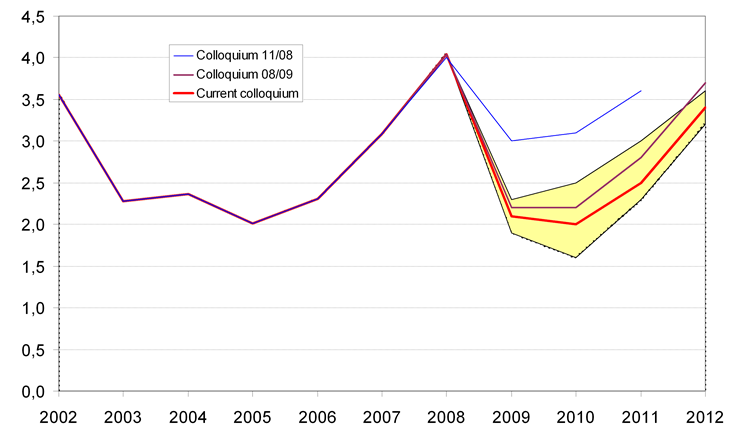

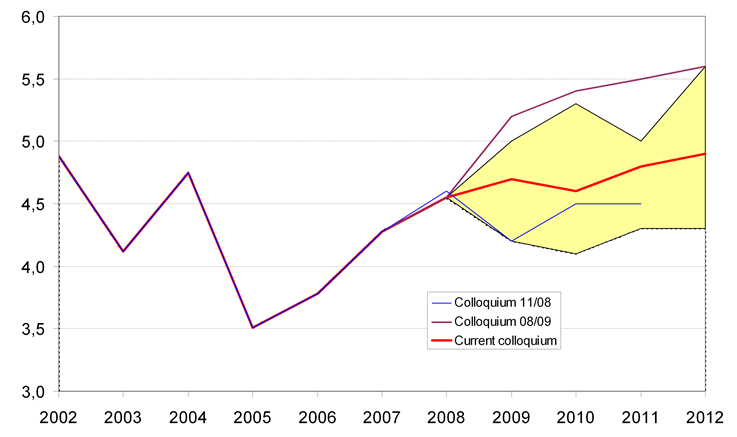

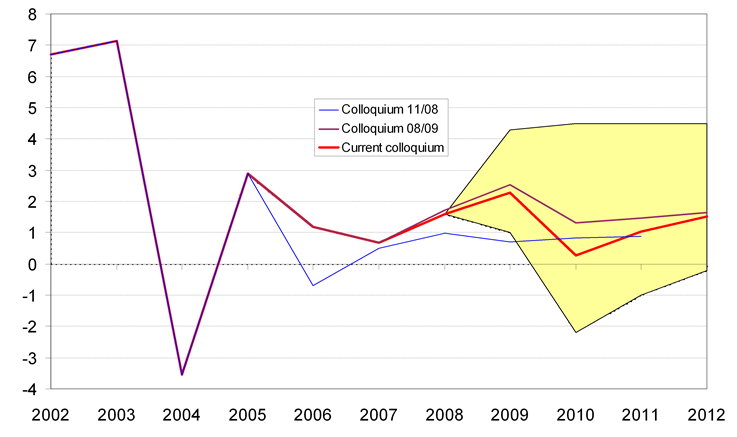

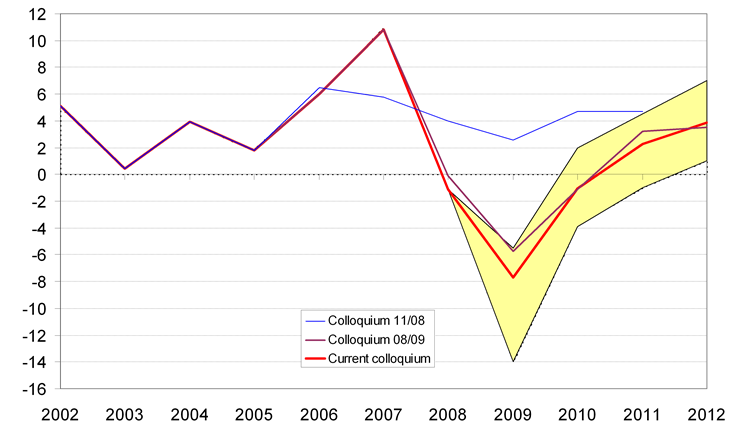

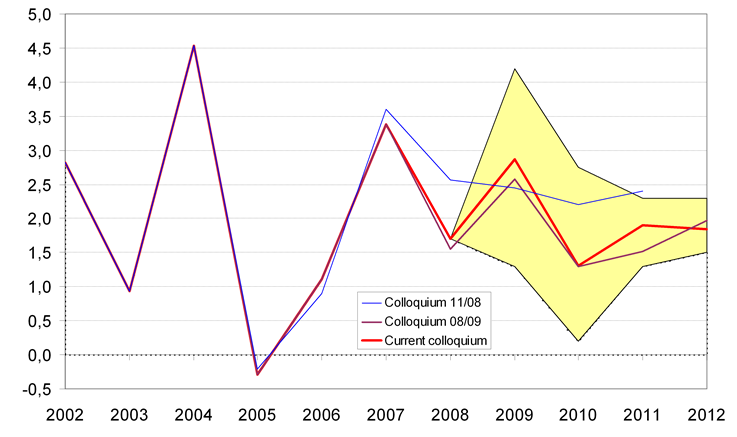

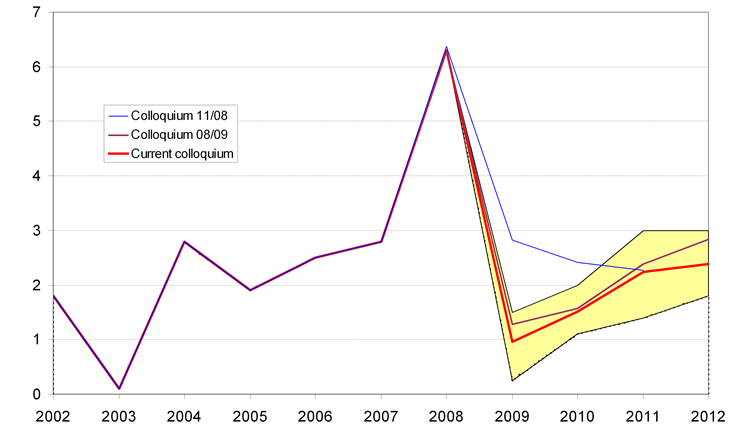

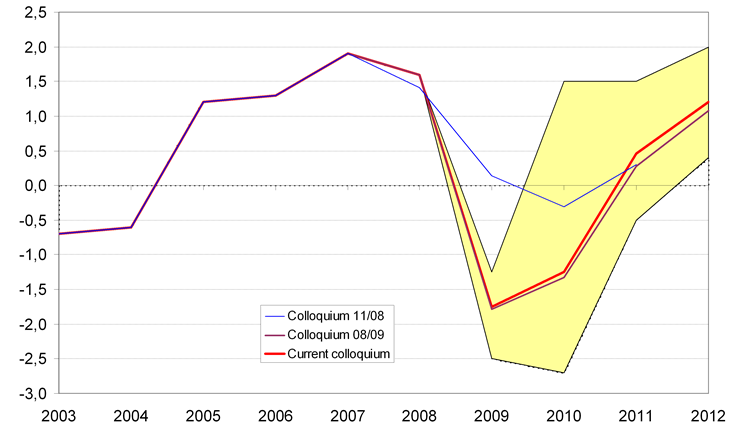

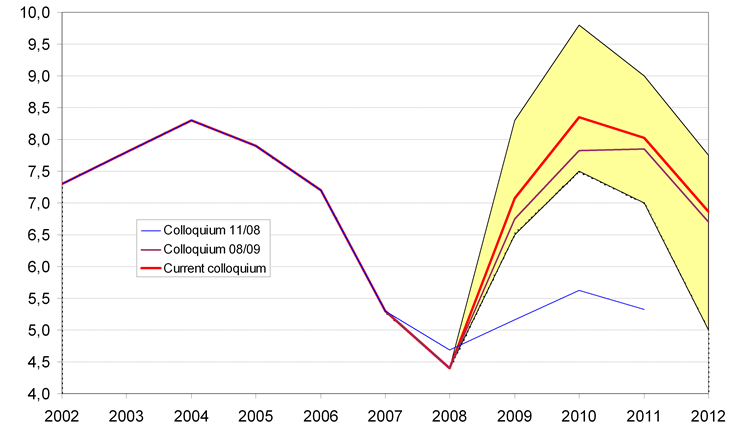

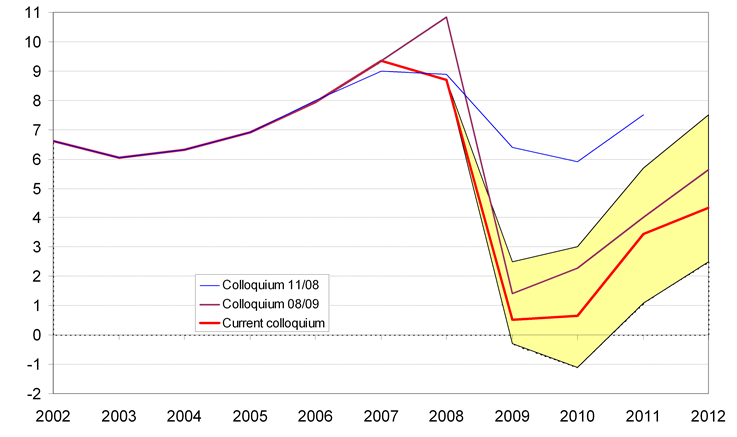

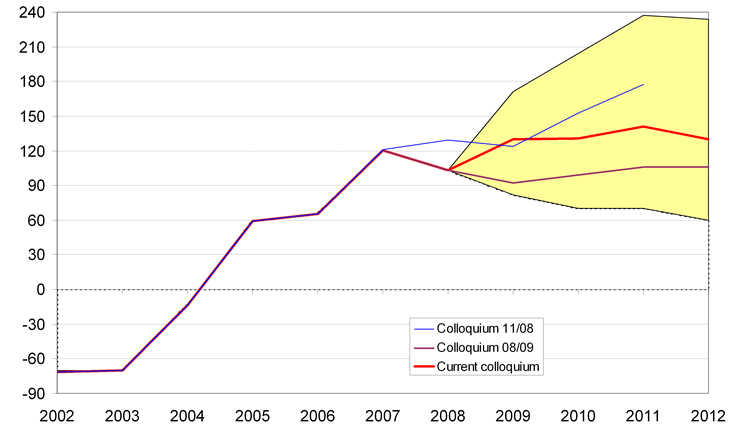

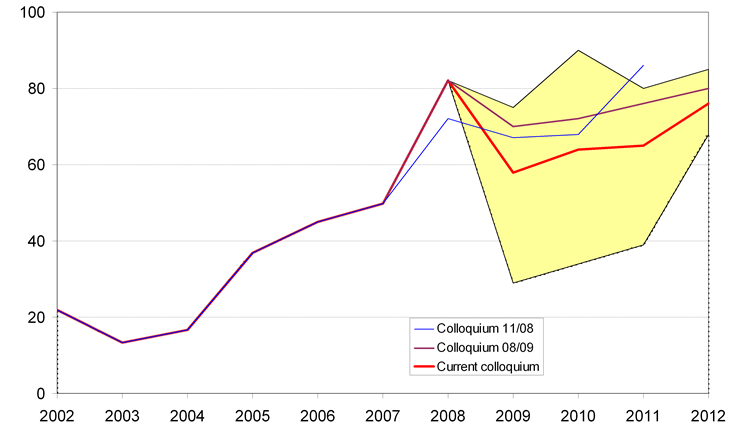

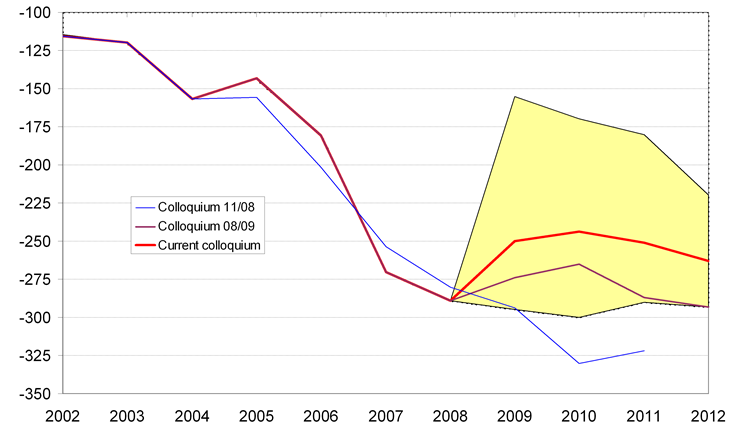

Graphic presentation of the past and assumed developments of individual indicators is seen in graphs 1-18. For the sake of comparison, also consensus forecasts of two previous Colloquiums are included. Extreme forecasts of indicators (min. and max. columns in the tables) form thresholds of the highlighted area.

Graph 1: Exchange Rate CZK/EUR

Graph 2: Exchange Rate USD/EUR

Graph 3: Price of Brent Oil

Graph 4: Short-term Interest Rates

Graph 5: Long-term Interest Rates

Graph 6: Gross Domestic Product

Graph 7: Household Consumption

Graph 8: Government Consumption

Graph 9: Gross Fixed Capital Formation

Graph 10: GDP Deflator

Graph 11: Consumer Prices

Graph 12: Employment (LFS)

Graph 13: Rate of Unemployment (LFS)

Graph 14: Wage Bill (domestic concept)

Graph 15: Trade Balance

Graph 16: Balance of Services

Graph 17: Balance of Income

Graph 18: Current Account of Balance of Payments

Graph 1: CZK/EUR exchange rate

Graph 2: USD/EUR exchange rate

Graph 3: Price of Brent oil

USD/barrel

Graph 4: Short-term interest rates

% p. a.

Graph 5: Long-term interest rates

% p. a.

Graph 6: Gross domestic product

Real growth in %

Graph 7: Household consumption

Real growth in %

Graph 8: Government consumption

Real growth in %

Graph 9: Gross fixed capital formation

Real growth in %

Graph 10: GDP deflator

Growth in %

Graph 11: Consumer prices

Average rate of inflation in %

Graph 12: Employment (LFS)

Growth in %

Graph 13: Rate of unemployment (LFS)

In %

Graph 14: Wages and salaries (domestic concept)

Nominal growth in %

Graph 15: Trade balance

Fob-fob - BoP, CZK bn

Graph 16: Balance of services

CZK bn

Graph 17: Balance of income

CZK bn

Graph 18: Current account of balance of payments

% of GDP