Czech Republic issues successful long 10-year EUR 2 billion Eurobond

On February 20th, The Czech Republic, rated A1, AA-, and A+ (all stable outlook) by Moody’s, Standard & Poor’s, and Fitch respectively, launched and priced a new long 10-year EUR 2bn Eurobond issue, achieving a coupon of 3.875%. Barclays Capital, Česká spořitelna (Erste Group), SG CIB and UniCredit were mandated as Joint-Lead Managers.

The successful issuance of the Czech Republic's first EUR benchmark after almost one-and-half year absence from the Euro market was well prepared by a highly professional 5-day European Roadshow during the week of the 13th of February. The Roadshow included group presentations and one-to-one meetings in Munich, Cologne, Frankfurt, Wiesbaden, Vienna, Amsterdam, The Hague, Paris, and London. Almost 50 investors had the opportunity to discuss the strong fundamentals of the Czech Republic with the Ministry of Finance delegation.

Based on strong investor feedback received during the Roadshow and the favorable market conditions the Joint Lead Managers started to collect indication of interests on Monday, 20th of February at 10:15 CET at mid-swaps +170bps area.

The orderbook officially opened at 13:10 CET with initial price guidance of mid-swaps +160-165 bps. The orderbook quickly reached over EUR 3bn. At 13:45 CET, the orderbook closed with over EUR 3.5bn of total size and over 190 single accounts participating. Based on this high quality orderbook, the spread was fixed at mid-swaps +160 bps, the very tight end of the initial spread guidance. The final size was set at EUR 2bn, the upper side of the announced range of EUR 1 – 2 bn.

The strong fundamentals of the country as one of the lowest indebted nation in the European Union allowed the Czech Republic to place its new long 10-year issue with a very limited issue premium of 5-7 bps to its existing secondary curve. This new issue premium is one of the lowest seen in 2012 so far in the Sovereign market and underpins the credibility and attractiveness of the Czech Republic as an issuer, thanks to both its high credit profile and its scarcity value. Furthermore, the spread for the Czech Republic's 10-year transaction is the lowest in the CEE region and it is the first 10-year transaction in the region in 2012.

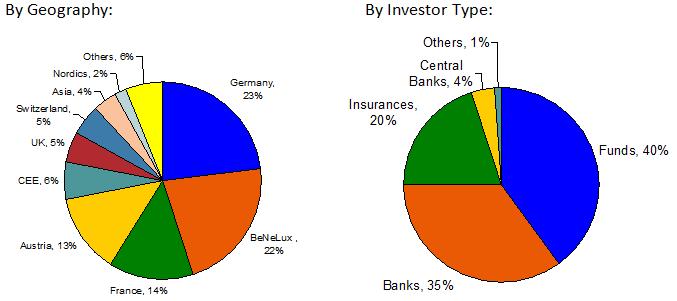

The high quality investor demand for the transaction was provided by Funds with 40% followed by Banks (35%) and Insurance Companies (20%). Central Banks took 4% of the transaction.

Major international demand came out of Germany (23%) and BeNeLux (22%). France and Austria followed with 14% and 13% respectively. CEE (6%), the UK (5%), Switzerland (5%) and other accounts (6%) completed the European contribution, while a remarkably solid demand of 4% came out of Asia.

Mr. Jan Gregor, Deputy Minister of Finance of the Czech Republic said: “This EUR 2bn transaction represents an important step in the execution of our funding strategy for 2012. I am very pleased with the execution and outcome of this transaction, in spite of its execution in volatile times. I particularly welcomed the strong participation of accounts visited during the European Roadshow, which proved our marketing efforts right. Furthermore, I really appreciate the investors' acknowledgement of our strong and stable credit fundamentals, as well as the reforms passed by the Czech Government.

Proceeds of the Czech Republic’s benchmark Eurobond transaction will be used for covering deficits of the State Budget, the repayment of state debt and other purposes authorised by law.

The Eurobond was issued off of the Czech Republic’s EUR 10 billion EMTN Programme, updated on February, 10th 2012.

Distribution Statistics:

DISCLAIMER:

A rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time by the assigning rating organization. Similar ratings on different types of notes do not necessarily mean the same thing. The significance of each rating should be analysed independently from any other rating.

This communication is not for distribution, directly or indirectly, in or into the United States (including its territories and dependencies, any State of the United States and the District of Columbia) or to U.S. Persons (as defined in Regulation S under the Securities Act of 1933, "Regulation S" and the "Securities Act", respectively), or in Australia, Canada or Japan. This communication is not an offer for sale of any securities in the United States or to U.S. Persons. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act. The Czech Republic, acting through the Ministry of Finance has not registered and does not intend to register any portion of any offering of securities in the United States or to conduct a public offering of any securities in the United States.

This communication is directed only at (i) persons who are outside the United Kingdom or (ii) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") and (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as "relevant persons"). Any investment activity to which this communication relates will only be available to and will only be engaged with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.